Roth Ira Eligibility 2025. For the 2025 tax year the ira contribution limit. Who can contribute to a roth ira?

Our analysis of the best roth ira accounts in 2025 considers the broad features banks, brokerages and emerging financial technology (fintech) firms provide alongside these. Individual retirement accounts (iras) are a common source of.

simple ira contribution limits 2025 Choosing Your Gold IRA, $7,000 if you're younger than age 50. 2025 contribution limits for different age groups:

What is a Roth IRA? The Fancy Accountant, You’re allowed to increase that to $7,500 ($8,000 in 2025) if you’re age 50 or older. Our analysis of the best roth ira accounts in 2025 considers the broad features banks, brokerages and emerging financial technology (fintech) firms provide alongside these.

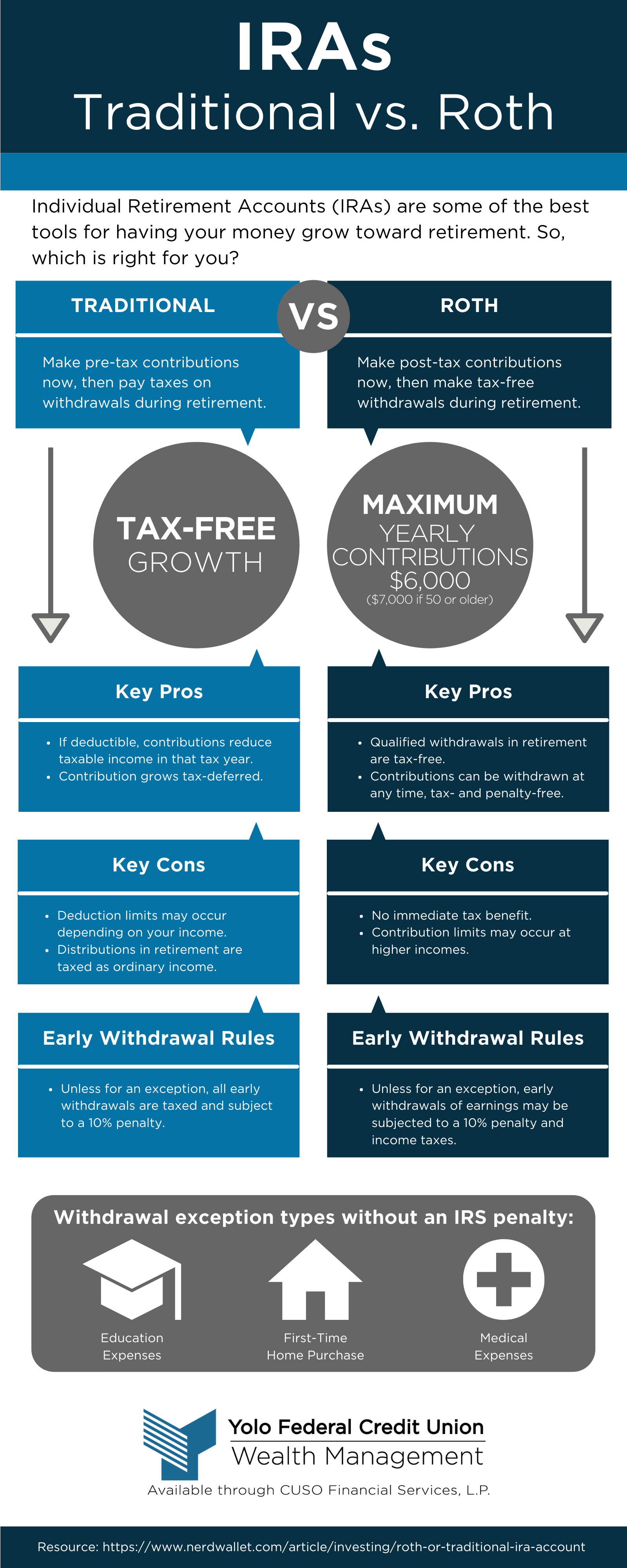

Traditional vs. Roth IRA Yolo Federal Credit Union, This figure is up from the 2025 limit of $6,500. $8,000 in individual contributions if you’re 50 or older.

What is a Roth IRA? The Fancy Accountant, Your roth ira contribution may be reduced or eliminated if you earn too much. The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

Roth or Traditional IRA Which Should You Choose? Morningstar, The roth individual retirement account (roth ira) has a contribution limit, which is $7,000 in 2025—or $8,000 if you are 50 or older. $8,000 in individual contributions if you’re 50 or older.

13 Roth IRA Rules You Should Know in 2025 The Logic of Money Roth, These same limits apply to traditional iras. 2025 contribution limits for different age groups:

Roth IRA 2025 Contribution Limit IRS Rules, Limits, and, Earned income is the basis for contributions, while. Our free roth ira calculator can calculate your maximum annual contribution for 2025 and estimate how much you'll have in your roth ira at retirement.

Your IRA Reset How to Assess Your IRA Planning in 2025 and Beyond, For the 2025 tax year, the maximum amount 1 you can contribute to a roth ira is $7,000, or $8,000 if you are 50 or older. Our free roth ira calculator can calculate your maximum annual contribution for 2025 and estimate how much you'll have in your roth ira at retirement.

Does a Roth IRA Account Make Sense for You? Gorfine, Schiller & Gardyn, You’re allowed to increase that to $7,500 ($8,000 in 2025) if you’re age 50 or older. $7,000 if you're younger than age 50.

Am I Eligible for a Roth IRA? Alto, You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2025. People with modified adjusted gross incomes below $153,000 (single) or $228,000.

Whether it makes sense to open a traditional or roth ira can depend on eligibility and the types of tax advantages you’re seeking.

(we say you may qualify for a tax deduction because there are certain income and eligibility requirements you must meet.