Standard Tax Deduction 2025 Married Jointly Vs. For 2025, the standard deduction. The irs has released the 2025 standard deduction amounts that you'll use for your 2025 tax return.

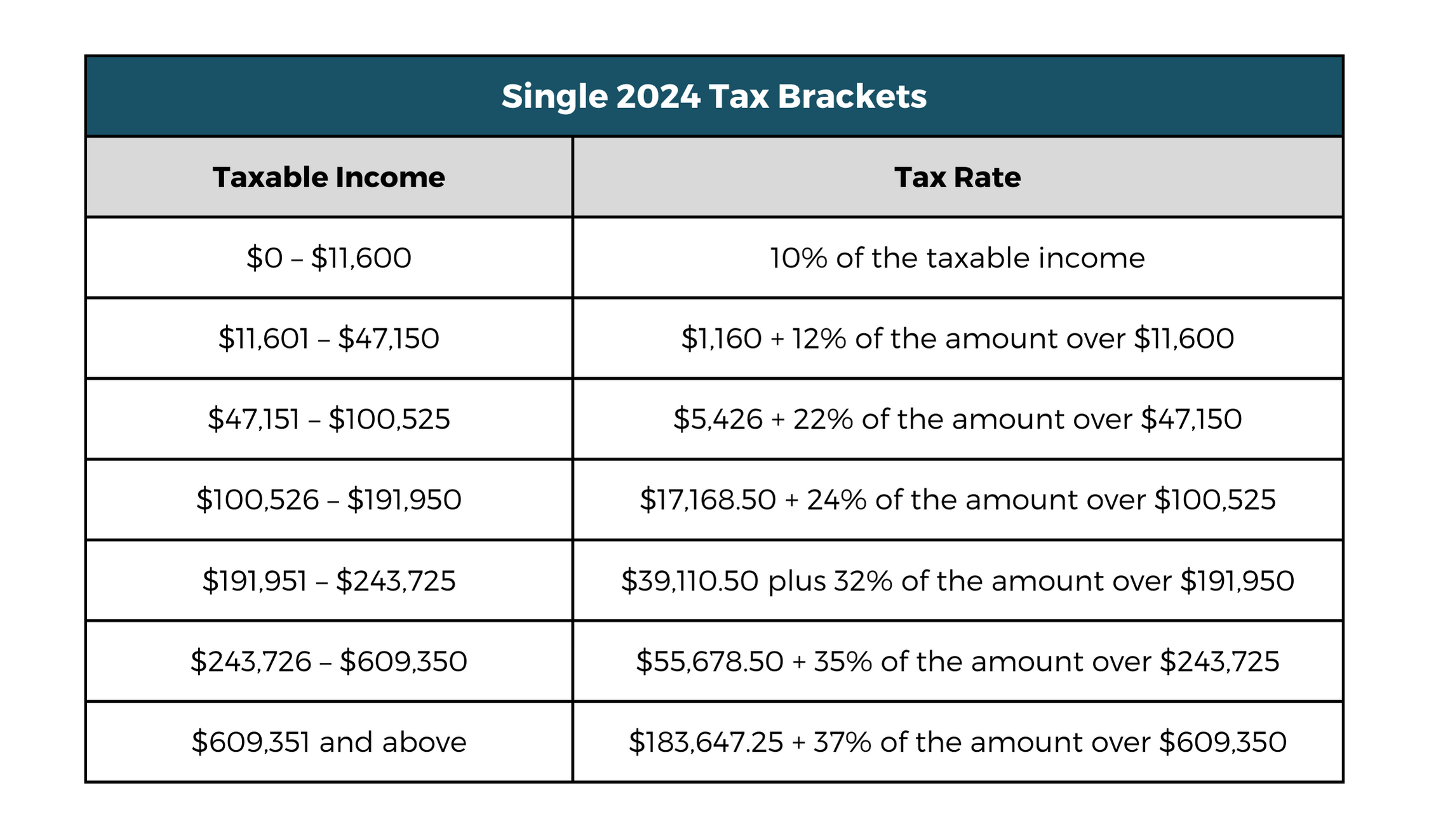

A deduction reduces the amount of a taxpayer’s income that’s subject to tax, generally reducing the amount of tax the individual may. The top tax rate will remain at 37% for married couples filing jointly, however the income bracket has increased from $693,750 in 2025 to $731,200 in 2025.

2025 Tax Brackets Formula Emelia, Here are the 2025 standard. 2025 tax year (filed in 2025) standard deductions by age:

2025 Tax Brackets Married Jointly Single Cherye Juliann, Married and filing jointly typically can net you a bigger standard deduction, reducing your taxable income—$27,700 for. While the tax code generally favors joint returns, some spouses may benefit from filing apart,.

What Are The Irs Tax Tables For 2025 Married Jointly Sharl Demetris, 2025 tax rates for other filers. Due to inflation, americans can keep more money from taxes next year.

2025 Tax Code Changes Everything You Need To Know RGWM Insights, People who are age 65. The deduction set by the irs for the 2025 tax year is as follows:

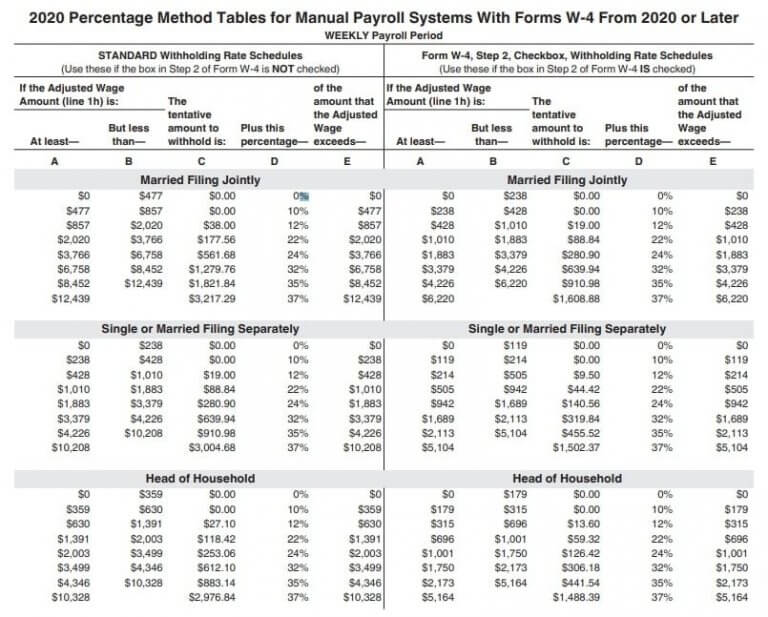

How to fill out IRS Form W4 Married Filing Jointly 2025 YouTube, Find the current tax rates for other filing statuses. The top tax rate will remain at 37% for married couples filing jointly, however the income bracket has increased from $693,750 in 2025 to $731,200 in 2025.

2025 Vs 2026 Tax Brackets Married Jointly Over Glori Kalindi, If you’re filing as single or married filing separately, you can deduct $13,850 for tax year 2025 (and $14,600 for tax year 2025). For 2025, the standard deduction.

Married Filing Jointly Vs Separately Calculator 2025 Dix Vickie, The calculator automatically determines whether the standard or itemized deduction (based on inputs) will result in the largest tax savings and uses the larger of the two values in the estimated. 2025 tax rates for other filers.

2025 Tax Brackets Irs Married Filing Jointly • Trend 2025, The federal standard deduction for a married (joint) filer in 2025 is $ 29,200.00. In 2025, it is $14,600 for single taxpayers and $29,200 for married taxpayers filing jointly, slightly increased from 2025 ($13,850 and $27,700).

IRS Sets 2025 Tax Brackets with Inflation Adjustments, The standard deduction for 2025 will rise to $29,200 for married couples filing jointly and to. The irs has released the 2025 standard deduction amounts that you'll use for your 2025 tax return.

Standard deduction for married filing jointly vs separately. TurboTax, Seniors over age 65 may claim an additional standard deduction. However, if you're trying to decide whether to itemize or take the standard deduction, the irs says, “you should itemize deductions if:

For the 2025 tax year (for forms you file in 2025), the standard deduction is $13,850 for single filers and married couples filing separately, $27,700 for married couples filing jointly and.